Home > Blogs > Post Content

|

|

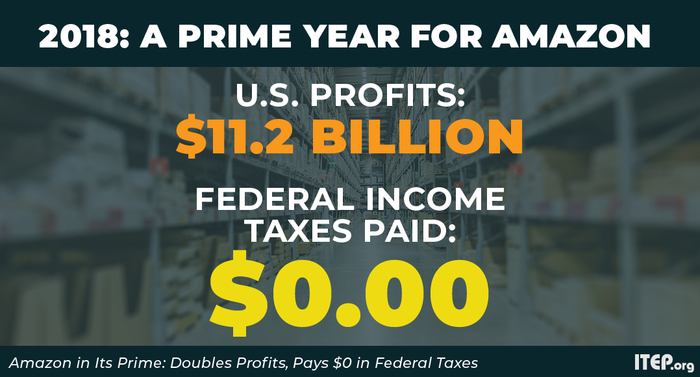

New York HQ Fiasco and Amazon's $0 in Federal Taxes Written by comanchee on February 16, 2019 Why should a large multi-billion dollar corporation pay no federal taxes and have the right to exploit workers for low pay, substandard healthcare and long hours? Not many people understand how they are being exploited by big business and have just as well accepted a form of modern day slavery. "Why should corporations that contribute nothing to the pot be in a position to take billions from the public?" A day after Amazon announced it was canceling plans to establish a new headquarters in New York City, critics pointed to a new report on the company's federal taxes for 2018 as more evidence that its exit was no loss for New York. The Institute on Taxation and Economic Policy (ITEP) on Friday released data showing that despite making more than $11 billion in profits in 2018, Amazon paid zero dollars in federal corporate taxes for the second year in a row. The company contributed nothing to public coffers thanks to President Donald Trump's tax plan that was passed into law in 2017 as well as tax credits for executive stock options. READ MORE: New York HQ Fiasco and Amazon's $0 in Federal Taxes https://afromerica.com/news&issues/afrotim...

Posted By: Dea. Ron Gray Sr.

Posted By: Dea. Ron Gray Sr.

Saturday, February 16th 2019 at 10:35AM

You can also

click

here to view all posts by this author...

|

|

It wasn't because of the new tax plan.

Saturday, February 16th 2019 at 1:17PM

Steve Williams

|

|

You paid more in taxes then Amazon paid, that is not right.

YOUR WORDS: It wasn't because of the new tax plan.

MY REPLY: Then what do you contribute Amazon paying no taxes at all, for years too?

Saturday, February 16th 2019 at 1:44PM

Dea. Ron Gray Sr.

|

|

How many years has it been since they paid taxes Ron?

Saturday, February 16th 2019 at 3:02PM

Steve Williams

|

|

Trump's Tax give a way to the rich just makes sure you will continue to pay more in taxes then billionaire AMAZON.

Saturday, February 16th 2019 at 3:33PM

Dea. Ron Gray Sr.

|

|

That's the wrong answer. Try again Ron.

Saturday, February 16th 2019 at 5:53PM

Steve Williams

|

|

The Institute on Taxation and Economic Policy (ITEP) on Friday released data showing that despite making more than $11 billion in profits in 2018, Amazon paid zero dollars in federal corporate taxes for the second year in a row.

Now Trump took office when?

How long has The Republicans had control of both The House and The Senate?

Saturday, February 16th 2019 at 7:24PM

Dea. Ron Gray Sr.

|

|

The Republicans do not have control of the Senate and Amazon has successfully avoided paying taxes for a long time, includinag all 8 years of the Obama administration. Do your homework Ron, don't be a dolt.

Saturday, February 16th 2019 at 11:31PM

Steve Williams

|

|

YOUR WORDS: The Republicans do not have control of the Senate

MY REPLY: You are right, if the Republicans Party give up the power of balance to TRUMP.

YOUR WORDS: Amazon has successfully avoided paying taxes for a long time, includinag all 8 years of the Obama administration.

Where did you get that information from because I have looked and can't find such info?

Sunday, February 17th 2019 at 12:07AM

Dea. Ron Gray Sr.

|

|

Here's a simple question Ron. Do the Rebublicans need 60 votes in the Senate to pass appropriations bills? An even simpler question, do the Republicans have 60 votes in the Senate? I gave you a link to a Newsweek article that is all about Amazon's tax maneuverings. I guess you didn't read it so I will try and find the SIMPLER links you seem to need.

Sunday, February 17th 2019 at 1:16AM

Steve Williams

|

|

How about this, from your very own Chicago Tribune. What a slacker.

From 2009 to 2018, the company earned roughly $26.5 billion in profit and paid approximately $791 million in federal taxes, for an effective federal tax rate of 3.0 percent for the period, according to ITEP's analysis. That is well below the statutory 35 percent corporate tax rate in effect for most of that period, as well as the 21 percent rate ushered in last year with 2017′s Tax Cuts and Jobs Act.

Sunday, February 17th 2019 at 1:20AM

Steve Williams

|

|

Earlier this week, Matthew Gardner of the Institute on Taxation and Economic Policy reported that Amazon, which recorded $5.6 billion in profits in 2017, paid zero in federal taxes, thanks to “various tax credits and tax breaks for executive stock options.” That’s remarkable in isolation, but especially remarkable when you consider that Donald Trump’s corporate tax bill hadn’t even gone into effect; Amazon projects it will get an additional $789 million in benefits from the passage of that bill. And it’s even more remarkable given that Amazon was already paying a much lower rate than other companies. The tax bill may have cut the corporate tax rate from 35 to 20 percent, but Amazon had paid only an 11 percent rate over the previous five years, meaning that “the company was able to shelter more than two-thirds of its profits from tax during that five-year period,” Gardner wrote.

Tax avoidance is not new to Amazon. “More so than any company I can think of,” Gardner told me, “Amazon appears to have built their profit maximization strategy around avoiding taxes at various levels.” Amazon has used local, state, and federal tax laws to its benefit, while doing everything in its power to avoid posting profits. (The stock market rewards the company anyway, as it uses its low-profit strategy to decimate competitors and swallow up industries.) It’s reached the point where Amazon, over the past few years, has made an effort to pay some tax—largely, it seems, to avoid bad press.

Sunday, February 17th 2019 at 1:30AM

Steve Williams

|

|

Thank you for making this point: From 2009 to 2018, the company earned roughly $26.5 billion in profit and paid approximately $791 million in federal taxes, for an effective federal tax rate of 3.0 percent for the period, according to ITEP's analysis.

That means Amazon paid a lesser rate in taxes than you did and that was my point.

Sunday, February 17th 2019 at 9:40AM

Dea. Ron Gray Sr.

|

|

Actually Ron, they did not. And no, that was not your point.

Sunday, February 17th 2019 at 10:03AM

Steve Williams

|

|

Sorry Steve, You can't sell that BULL💩 here because it is all right here in Black and White.

STOP LYING STEVE!!! Your tax rate is higher than AMAZON paid out in taxes unless you pay in taxes less then 3.0 percent in federal taxes in the last TWO Years, is that possible?

Sunday, February 17th 2019 at 3:54PM

Dea. Ron Gray Sr.

|

Blogs Home

|

|

|